Latest Commentaries

Sunday 22 February 2026

All of Sir Ronald's commentaries up to 19th February 2026 can be read in the "Commentaries" section of this website. The most recent one is entitled, "If US Secretary Rubio attends CARICOM Summit: Let It Mark a Reset, Not a Reckoning".

The Commentary argues: If U.S. Secretary of State Marco Rubio accepts the invitation to attend the CARICOM Heads of Government meeting in St Kitts and Nevis from 25 to 27 February, his presence should be treated as consequential. It would offer an opportunity to recalibrate the relationship between the United States and the fifteen Member States of CARICOM that has never been broken, but now requires deliberate renewal.

The U.S. and the Caribbean Community are not strangers testing first principles. Geography binds us. Trade sustains us. Security concerns connect us. Migration links our families. For decades, cooperation between Washington and Caribbean capitals has been steady, pragmatic, and grounded in mutual interest.

Secretary Rubio has spoken forcefully about sovereignty, economic resilience, border control, and the dangers of surrendering national agency to external forces. Caribbean leaders understand that language instinctively.

Our region’s modern history is rooted in claiming our legal entitlement to sovereignty, building viable economies out of colonial inheritances, and defending democratic institutions in societies small in size but firm in conviction.

There are no communist political movements steering CARICOM governments. There are no ideological crusades underway in the Caribbean. Our politics are practical. Across administrations and across party lines, Caribbean governments have pursued market-driven economies tempered by social responsibility. We rely on private enterprise, welcome investment, and maintain deep commercial ties with the United States, which remains our largest trading partner.

With the exception of Guyana and Trinidad and Tobago, whose energy exports alter the arithmetic, the United States enjoys consistent trade surpluses in goods, and substantial commercial advantages overall, with most CARICOM member states.

American goods fill Caribbean ports. American companies operate profitably in our economies. American visitors enjoy our tourism industries. Cooperation in drug interdiction and in combating organized crime has been structured and ongoing under the Caribbean Basin Security Initiative. These are not the markers of strained relations. They are the foundations of a long partnership.

Yet strain has emerged, and it must be acknowledged honestly if recalibration is to occur.

See the entire commentary in the commentaries section.

Latest News in Pictures

Sunday 22 February 2026

On Friday, 13 February 2026, Sir Ronald was installed as Chancellor of the Univeristy of Guyana, having been elected by the University Council and endorsed by the President of Guayana, Mohamed Irfaan Ali and the Minister of Education, Sonia Parag, The photgraphs above are from the ceremony of istallation - President Ali greeting Sir Ronald as Chancellor and the Chancellor receiving the apprroval of the congregation.

Sir Ron delivering the 2025 Distingusihed Lecture of the Organization of Commnwealth Caribbean Bar Associations (OCCBA) on 25 November 2025, The lecture was delivered to a live audience at the University of Guyana with more tnan 500 participants on-line from throughout the Commonwealth Caribbean and the dispoia community. The Lecure, in honor of the memory of Commonwealth and Caribbean Statesman, Sir Shridath Ramphal, was entitted: " Has the Rule of Law Been Replaced by ‘Might is Right’? Defending Sovereignty and Promoting Peace in the Caribbean".

.jpg)

Sir Ron receieving the Honorary Degree of Doctorof Laws (Honorris Causa) from the University of Guyana on 22nd November 2025 for "his role as a "transformative figure in diplomacy, business, and academia", and for his enduring commitment to good governance and the advancement of the Caribbean.

Sir Ron answering questions after delivering the Lecture "THE INTER-AMERICAN SYSTEM: ILLUSION, REALITY, AND REFORM, to the Class of 2025 of the Inter-American Defense College in Washington, DC on 8 October, 2025

.jpg)

Signing Agreement with Sri Lankan Ambassador to the US, Mahinda Samarasinghe, to establish diolomatic relation beween Antigua and Barbuda and Sri Lanka. The signing took place on 3 Ocober 2025 in Washington, DC. In top photograph, my Deouty Head of Mission, Joy-Dee Davis-Lake is to my right,

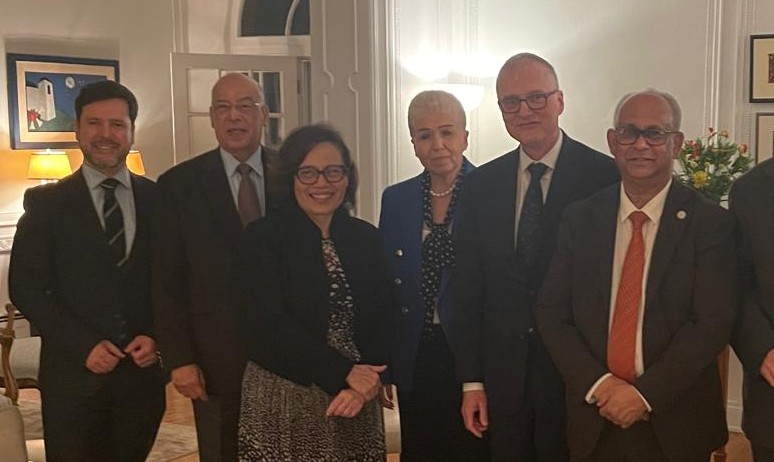

Sir Ronald (second from right - front row) with OAS Ambassadors, Luz-Elena Banos of Mexico (to his right), behind them (second row) Luis Ernesto Varga of Colombia, and Alejandra Solano of Costa Rica (to his left) at a Consultation on Public Policies Against Poverty and Inequality,” September 26, 2025. Sir Ronald spoke on "Poverty, Public Debt, and Climate Change".

Welcome dinner for Albert Ramdin (first right) on June 1, 2025 hosted by the Ambassador of Brazil, Benoni Belli (second right). Ambassador of Mexico, Luz Elena Banos, Vice Minister of Brazil, me.

Hosting a Farewell Luncheon for outgoing OAS Secretary General, Luis Almagro, with CARICOM friends on May 12, 2025

On 6th March 2024, with Ambassador of Ukraine to the US., Oksana Serhiyivna Markarova , after we had lunch in Washington DC to discuss bilateral matters and the ongoing war by the Russian Federation against Ukraine

Sir Ron with Presdient of Guatemala, Berardo Arevalo, President of Guatemala and Foreign Minster, Carlos Ramiro Martinez on the 13 Janauary 2024 (on the eve of Arevalo's installation as President)

With the President of Guatemala. Alejandro Gammettei, who invited Sir Ronald as Chair of the Permanent Council of the OAS to revew the transitiion of Governnment in Guatemala - 15 December 2023

Sir Ronald, as Chair of the OAS Permanent Council meeting representatives of the Constititional Court in Guatemala on 15 Decemeber 2023. Left to Right, Franchesca Sterling, Adviser to the OAS Secretary General;. President of the Court, Hector Hugo Perez Aguilera; Senior Judge, Leyla Susana Lemus Arriaga, Sir Ronald, and Luis Almagro, Secretary General of the OAS

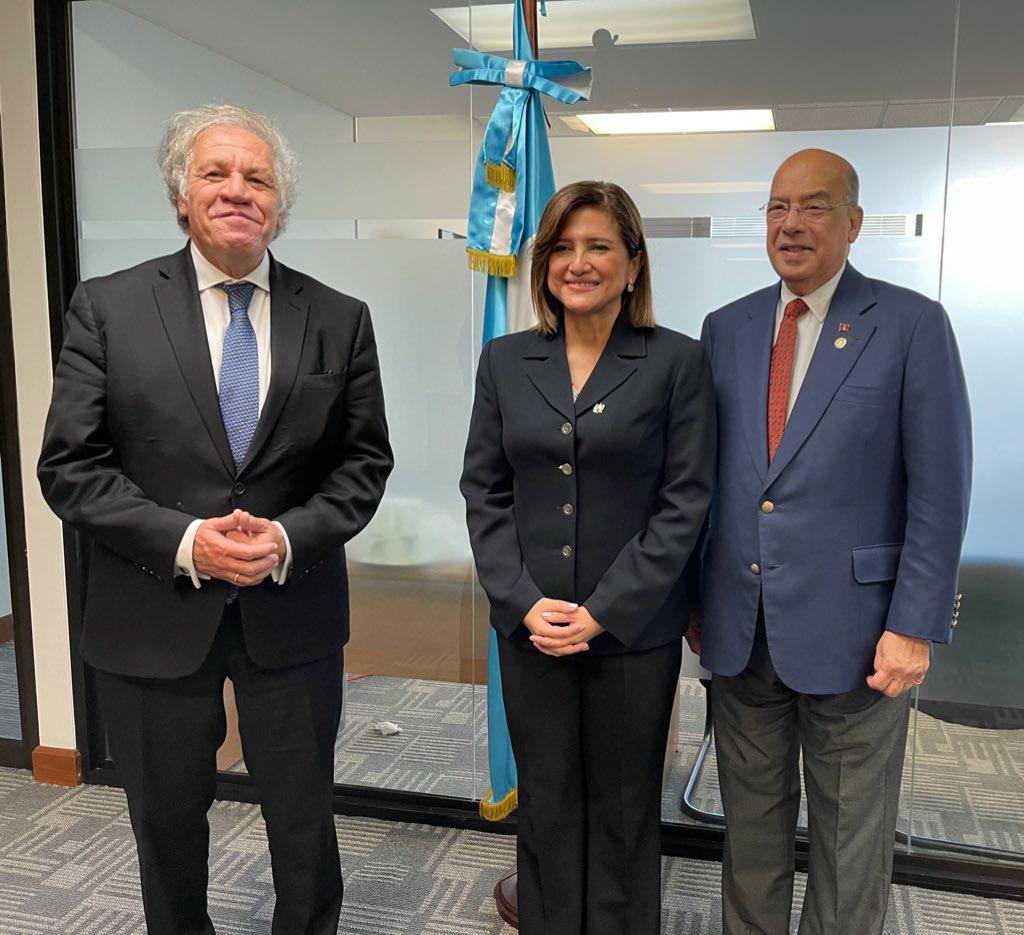

Luis Almagro, OAS Secretary=General; Karin Herrera, Vice President-Elect Guatemala, and Sit Ronald in Guatemala on 16 December 2023

On 3 November 2023, greeting the President of Costa Rica. Rodrigo Chaves Robles, at the OAS for a meeting at which I presided as President of the Permenant Council (left to Right SG Luis Alamagro, President Chaves, Me, Foreign Minister of Costa Rica, Arnoldo Andre Tinoco, and Nestor Mendez, Assistant Secretary General, OAS

With the President of Paraguay. Santiago Pena, at meeting of the OAS Permanent Council on 23 October, 2023

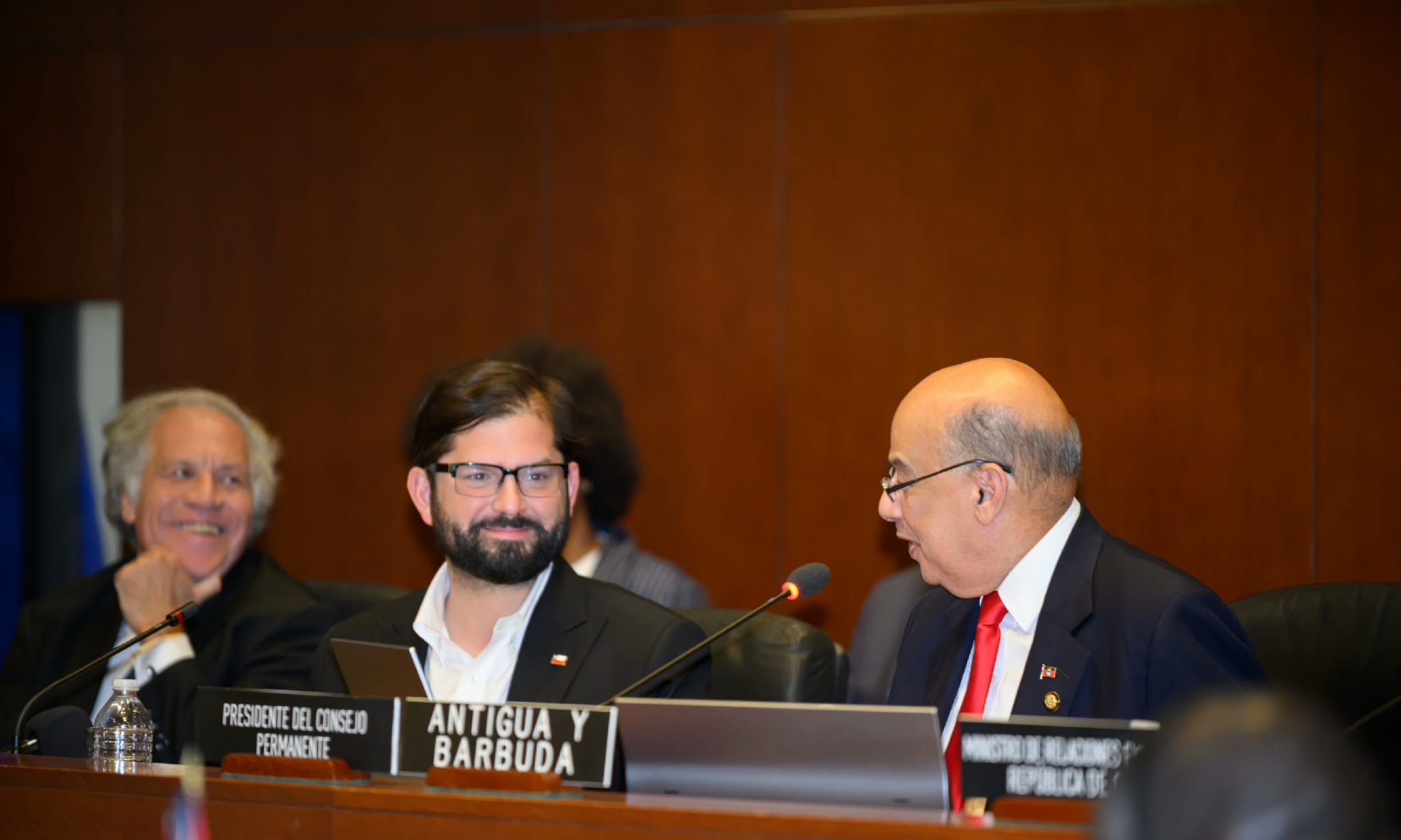

With the Preisdent of Chile Gabriel Boric (Centre) on 22 September 2023. Lusi Almago, OAS Secretray General (left of photograh)

With the Secretary of State for the District of Columbia, Kimberly A. Bassett. We met this week at a receptionon 6 September 2023 marking Brazil’s National Day

With the Secretary of State for the District of Columbia, Kimberly A. Bassett. We met this week at a receptionon 6 September 2023 marking Brazil’s National Day

Official photograph of Heads of Delegation to the 53rd Regular Session of the General Assembly of the Organization of American States (OAS). In the background is the rarely seen back ot the OAS Headquarters building in Washington, DC on June 23rd 2023

10 May, 2023 at the Permanent Mission of Colombia. A bust of the celebrated literary giant Gabriel Garcia Marquez (Author of “One hundred days of Solitude” and many more outstanding works). With the Colombia Ambassador to the OAS, Luis Ernesto Vargas.

With the President of Colombia Guistavo Petro at the Organization of American States (OAS) on 19 April 2023, afrer he made a rousing speech on freedom and political rights

Sir Ron speaking at the Danish Embassy in Washigton, DC in a converastion on Climate Chane and Peace and Security on March 23, 2023

Sir Ron and former Foreign Minister of Denmark, Holger K. Nielson, at the Antigua and Barbuda Embassy in Washigton, DC on 24 March 2023, after a useful exchange of views on Peace and Security and the importance of the presence of Small States on the UN Security Council

Sir Ron signing, with Serbian Amabassador, Marko Djuric, agreement. mutually abolishing visa requirments between Antigua and Barbuda and Serbia in Washington, DC on 11 March, 2023. At left in the photograph is Joy-Dee Davis, Minister-Counsellor in the Antgua and Barbuda Embassy

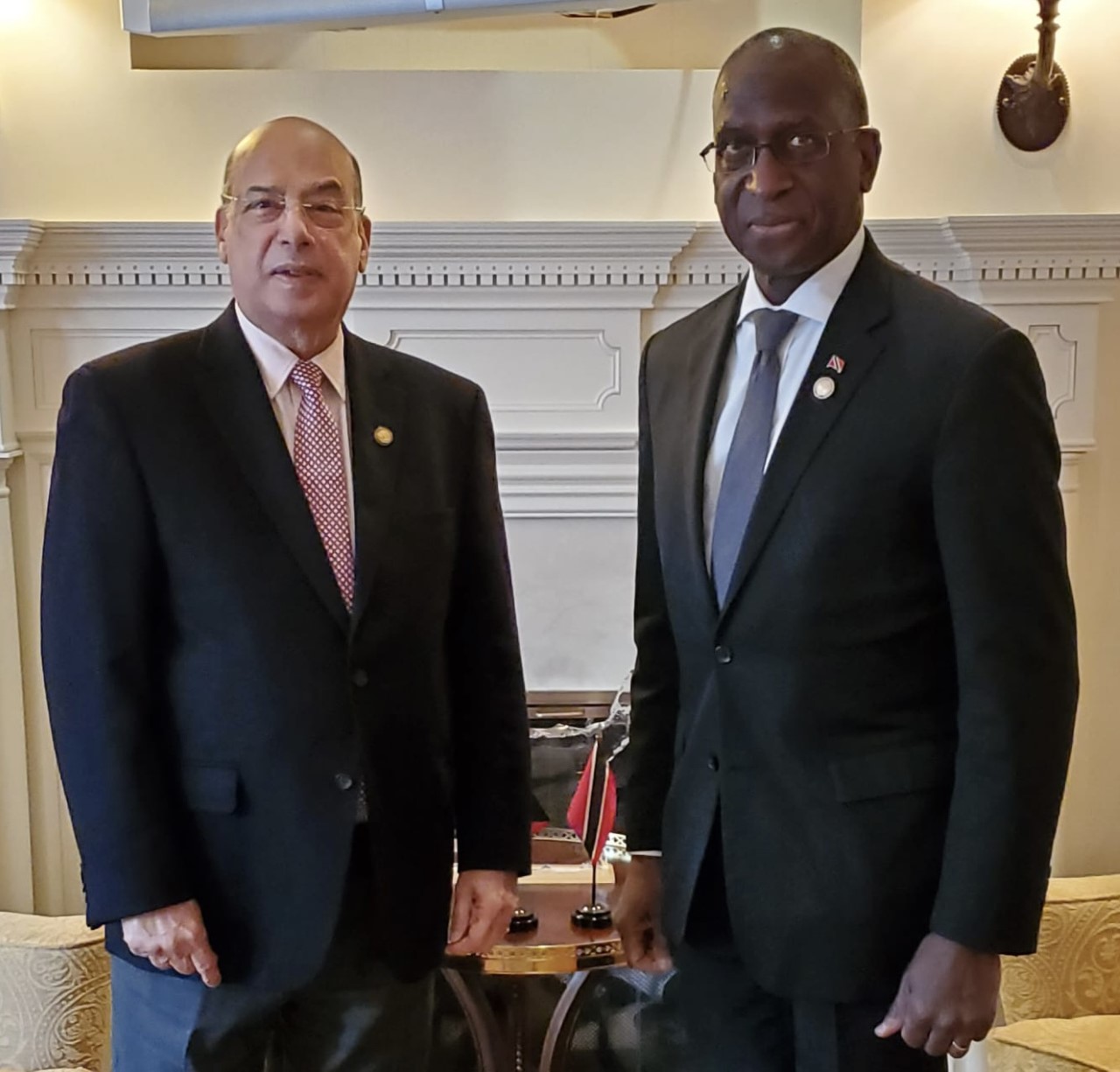

Sir Ronald Sanders (Antigua and Barbuda) and Ambassador Anthony Phillips-Spencer (Trinidad and Tobago) are the two senior Caribbean Ambassadors in the US and to the OAS. On 13 February, 2023 they met to discuss implementation of priority matters for the Caribbean in the US and the OAS.

.jpeg)

In February 2023, the Ambassador of the Maldives to the US called on Sir Ronald Sanders at the Antigua and Barbuda Embassy in Washington, DC to discuss issues related to small states in the international community. Climate change was a priority of their discussion.

With US Ambassador to the Organizaion of American States (OAS), Frank Mora, at the Antigua and Barbuda Embassy in Washington, DC, Februrary 2023

With the lady Ambassadors accredited to Antigua and Barbuda in December 2023. Left to Right, the Ambassador of Cuba, Maria Esther Fife; Ambassador of the Dominican Republic, Raquel Jacobo; and Ambassador of Venezuela, Carmen Velazquez De Visbal (December 2022) in Antigua

At the Summit of the Americas in Los Angeles on 10 June 2022: Sir Ronald, OAS Secretray-General Luis Almagro and Antigua and Barbuda Prime Minister, Gaston Browne.

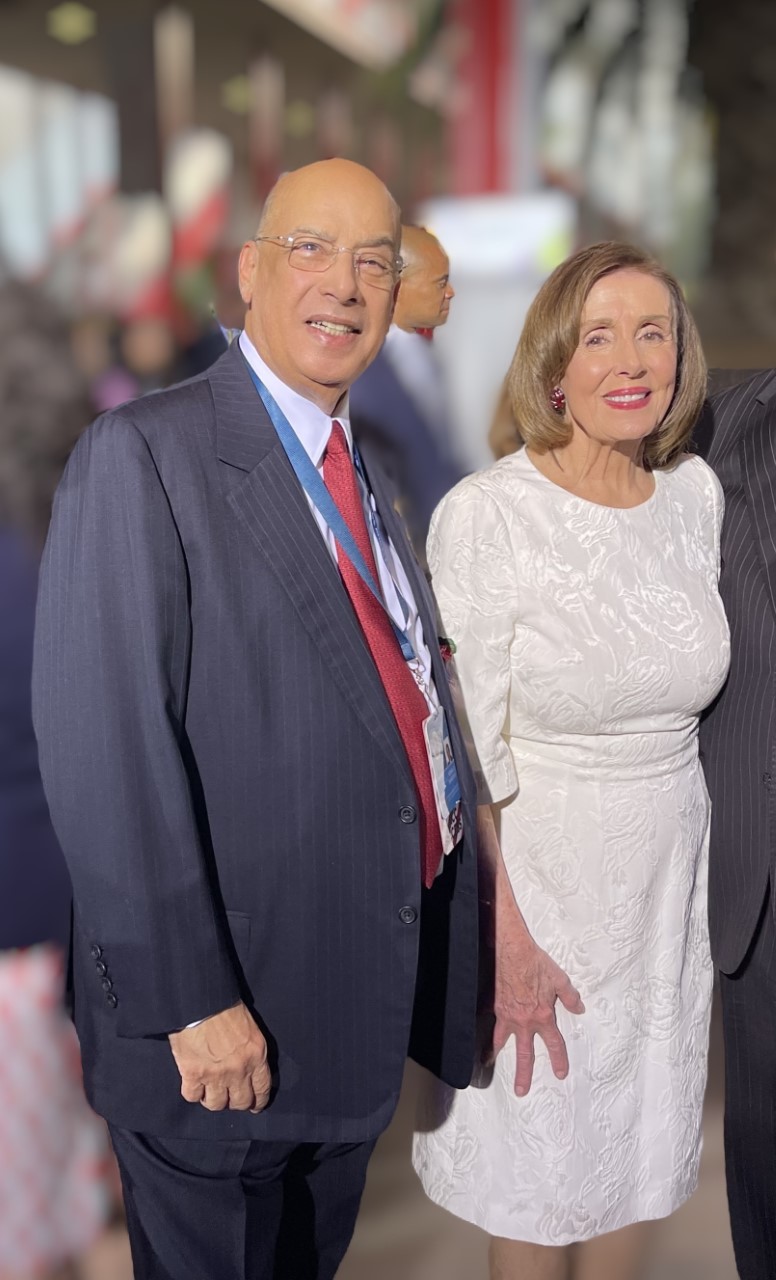

Sir Ronald with The Honourable Nancy Pelosi, the formidable Speaker of the US House of Representatives on Thursday 9 June 2022 during the Ninth Summit of the Americas in Los Angeles

Senator Chris Dodd, Adviser to President Biden on the Ninth Summit of the Americas and the man largely responsible for convinng many Caribbean and Latin American leaders to attend, with Sir Ronald.

Meeting in Barbados between Representatives of the US State Department anf Senior Representatives of Easrern Caribbean Governments. Front row left to right: Senator (St Vincent and the Grenadines), US Ambassaor to Barbados and the Eastern Caribbean States;. Brian Nichols Assistant Secretary, US State Department, Earl Huntley Senior Adviser to St Lucia Foreign Minister, Sir Ronald Sanders representing government of Antigua and Barbuda. Back row left to right: St Kitts-Nevis Ambassador to the US Thelma Phillips-Browne; Permanent Secretary Barbados Ministry of Foreign Affairs; Nan Fide, Director Caribbean, US State Departmenent; Foreign Minister of Dominica; Minister of Health Grenada, Deputy Chief of Mission, US Embassy in Barbados.

On 18th May 2022, at State House in Guyana with Guyana President Irfaan Ali and Barbados Prime Minister, Mia Mottely prior to "Agri-Invest Expo and Forum" which set the stage for an actionable, time bound plan for food sercuity, energy security, removal of trade barriers and regional trsnsportation.

Speaking at a meeting between Caribbean leaders and a US Congressional team, led by Congresswoman Maxine Waters, in Barbados on Wednesday 20 April 2022 . I was pleased to initiate this process of consultation, as Antigua and Barbuda’s Ambassador, with Congresswoman Waters in July 2019 (.(see photo in date order below with the Congresswoman in July 2019). Subsequently, in November 2019 we had the first Roundtable in Washington.

In an interview with British Channel 4 News, Sir Ronald explains that Britain must make MLAT request for assistance regarding two Yachts in Antigau waters allegedly owned by sanctioned Russian Oligarch, Roman Abramovich:

See: What has happened to yachts linked to Roman Abramovich? – Channel 4 News

With the Foreign Minister of Guatemala, Mario Adolfo Bucaro Flores, to discuss CARICOM-Central America cooperation and deepening relations at the OAS. At the right of the photograph is Rita Calverie di Scioli, the Guatemalan Ambassador to the OAS, 31 March 2022

With the Foreign Minister of Guatemala, Mario Adolfo Bucaro Flores, to discuss CARICOM-Central America cooperation and deepening relations at the OAS. At the right of the photograph is Rita Calverie di Scioli, the Guatemalan Ambassador to the OAS, 31 March 2022

Members of the Committee appointed by the Vice Chancellor of the University of London to Inquire into the Future of Commonwealth Studies at the University. The report was submitted at the end of July 2021 and the Institute of Commonwealth Studies was given a renewed and expanded mandate.

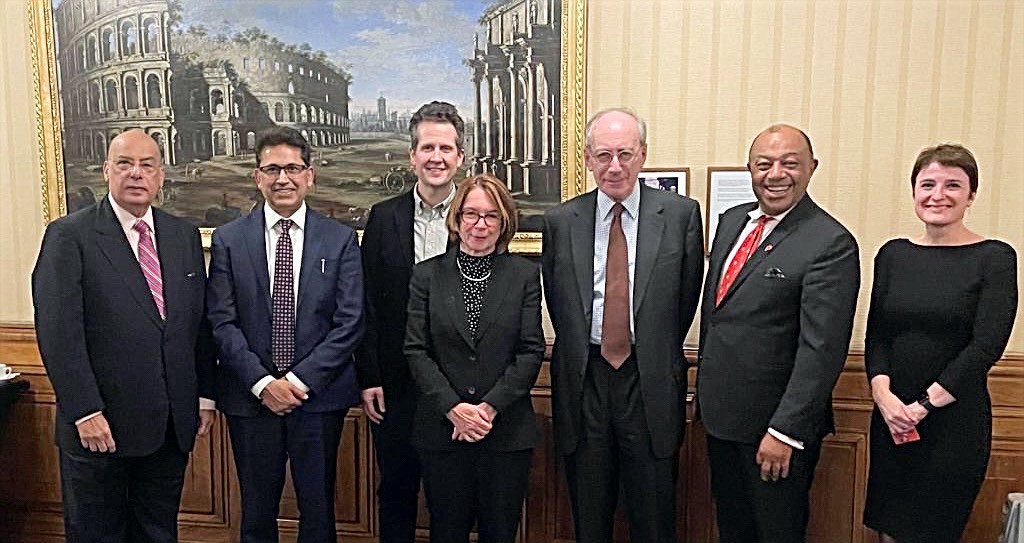

Left to Right: Sir Ronald Sanders, Nabeel Goheer, Dr Conor Wyer, Professor Wendy Thomson - Vice Chancellor - Sir Malcolm Rifkind (Chairman) Lord (Paul) Boateng, Jo Fox - Dean of the School of Advanced Studies. Photo at Senate House. London, November 3rd 2021.

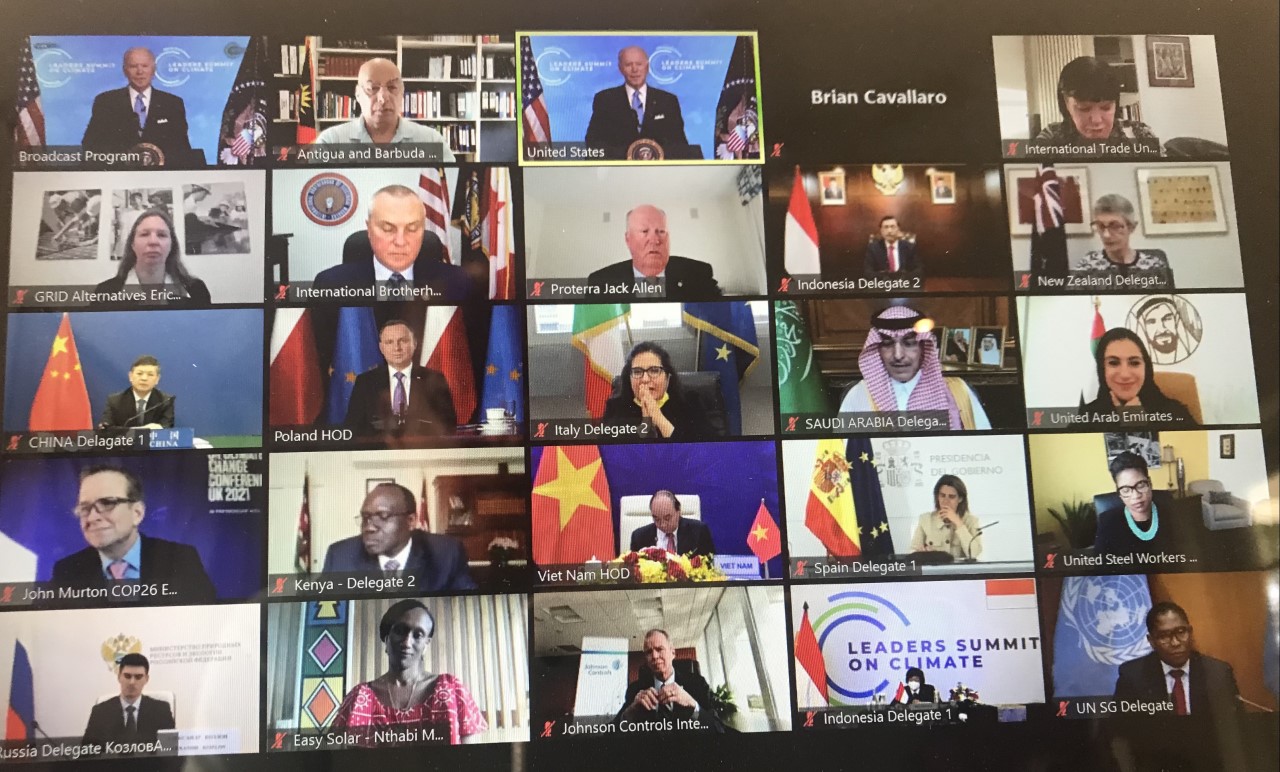

Participating as a delegate from Antigua and Barbuda in the Summit of 40 Leaders on Climate, organised by us President, Joseph Biden, on 22 and 23 April 2021. Sir Ronald second from left at top.

With the late Right Honourable Professor Owen Arthur, former Prime Minister of Barbados at his office at the Cave Hill Campus of the University of the West Indies in January 2020, talking Caribbean integration

Meeting between US Congressional Representatives, Global Banks and Caribbean government representative. Congresswoman Maxin Waters (centre in red), Antigua and Barbuda Prime Minister Gaston Browne to her right, Sir Ronald Sanders to Prime Minister Browne's right. Capitol Hill on November 14, 2019

Meeting between US Congressional Representatives, Global Banks and Caribbean government representative. Congresswoman Maxin Waters (centre in red), Antigua and Barbuda Prime Minister Gaston Browne to her right, Sir Ronald Sanders to Prime Minister Browne's right. Capitol Hill on November 14, 2019

.jpg) Signing agreements for the establishment of diplomatic relations between the Republic of Kosovo and Antigua and Barbuda in Washington, DC on 24 July 2019. The agreemenst were signed by the Ambassador of Antigua and Barbuda, Sir Ronald Sanders (sitting right) and the Ambassador of the Republic of Kosovo, Vlora Citaku (sitting left). Frymezin Isufaj and Joy-Dee Davis. Ministers Coundellor (standing left to right)

Signing agreements for the establishment of diplomatic relations between the Republic of Kosovo and Antigua and Barbuda in Washington, DC on 24 July 2019. The agreemenst were signed by the Ambassador of Antigua and Barbuda, Sir Ronald Sanders (sitting right) and the Ambassador of the Republic of Kosovo, Vlora Citaku (sitting left). Frymezin Isufaj and Joy-Dee Davis. Ministers Coundellor (standing left to right)

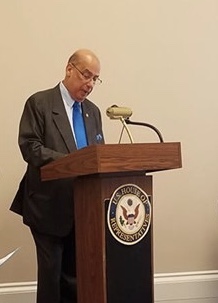

Speaking at US Capitol Hill in behalf of CARICOM during Caribbean Legislative Week on 5 June 2019

Speaking at US Capitol Hill in behalf of CARICOM during Caribbean Legislative Week on 5 June 2019

Meeting Wesley Kirton Co-Chair Caribbean Studies Associaton, US, and Captain Gerry Gouveia of the Guyana Privat Sector at Antigua and Barbuda Embassy, Washington, DC on 4 June 2019

Meeting Wesley Kirton Co-Chair Caribbean Studies Associaton, US, and Captain Gerry Gouveia of the Guyana Privat Sector at Antigua and Barbuda Embassy, Washington, DC on 4 June 2019

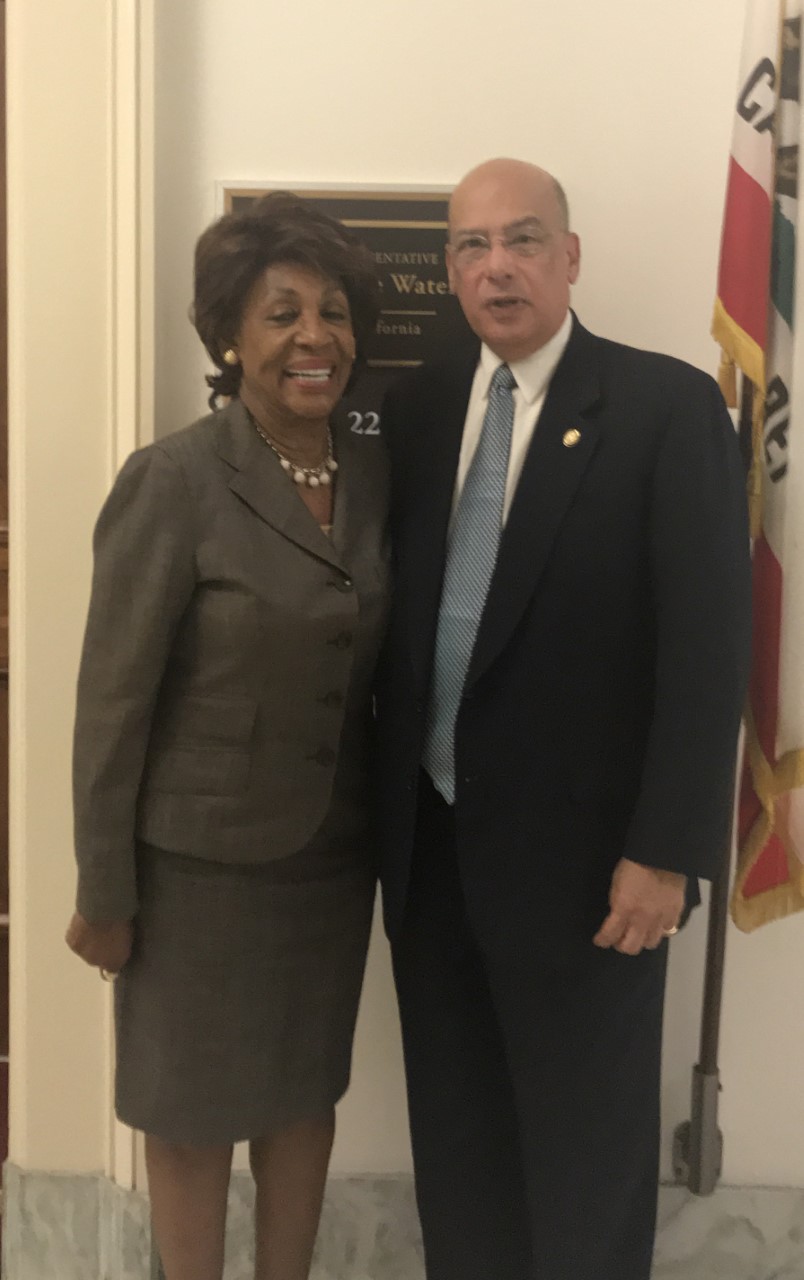

On 15 May, 2019 with the formidable US Congresswoman Maxine Waters who is Chair of the Financail Services Committee of the US House of Representatives. I had presentred the case against de-risking, withdrawal of correspondent banking relations and blacklisting alone with CARICOM Ministers of National Security.

On 15 May, 2019 with the formidable US Congresswoman Maxine Waters who is Chair of the Financail Services Committee of the US House of Representatives. I had presentred the case against de-risking, withdrawal of correspondent banking relations and blacklisting alone with CARICOM Ministers of National Security.

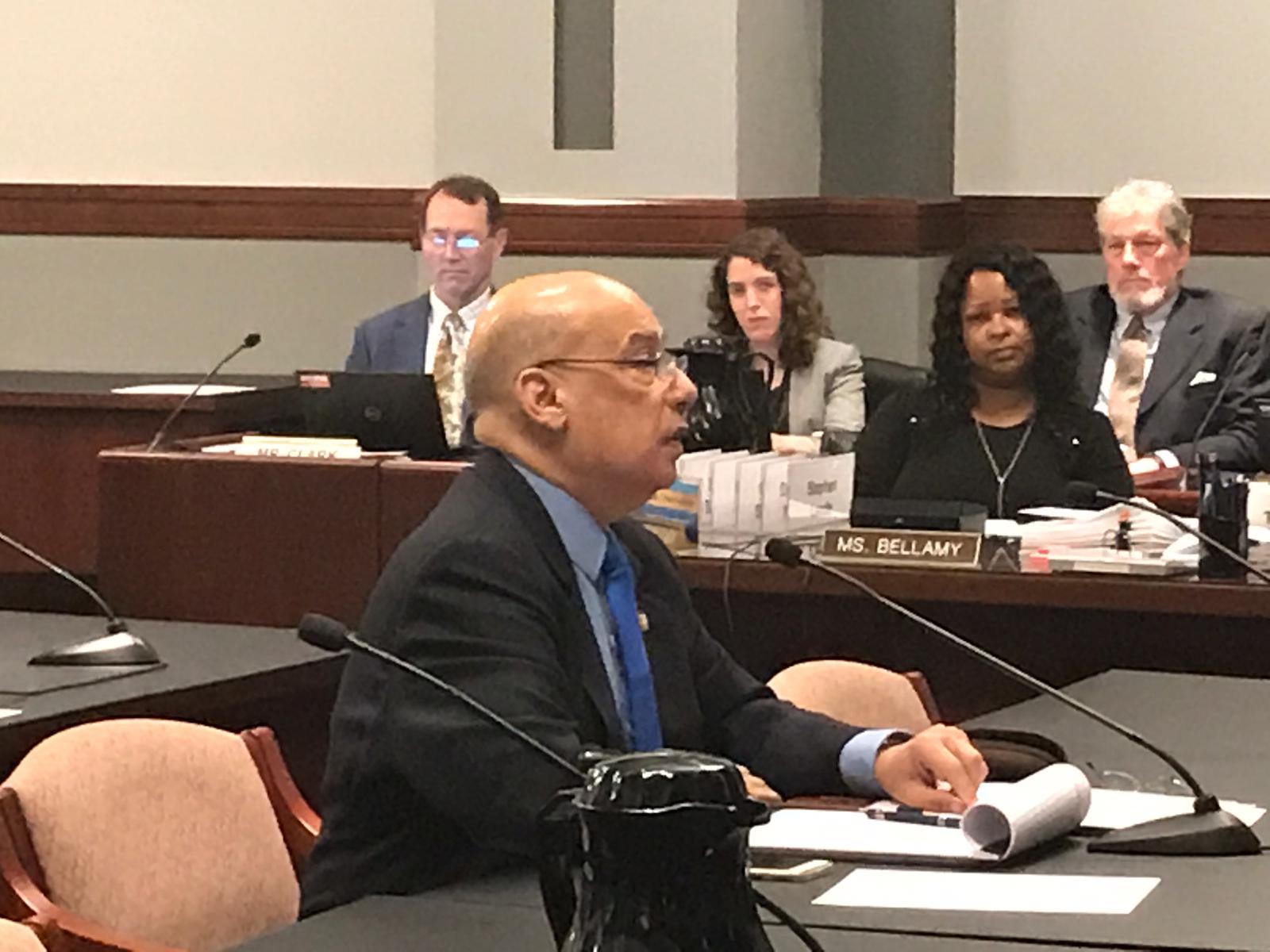

Testifying on 14th May, 2019 before the US International Trade Commission on behalf of Antigua and Barbuda and Caribbaean States on the perennial US trade surplus with the region which reached $7 Billion in 2018.

Testifying on 14th May, 2019 before the US International Trade Commission on behalf of Antigua and Barbuda and Caribbaean States on the perennial US trade surplus with the region which reached $7 Billion in 2018.

Sir Ronald at Capitol Hill in Washington DC, talking trade and other relations between the US and CARICOM countries, especially Antigua and Barbuda, with Cingressman Brad Wenstrup (R-Cincinnati) on 27 February 2019.

Sir Ronald at Capitol Hill in Washington DC, talking trade and other relations between the US and CARICOM countries, especially Antigua and Barbuda, with Cingressman Brad Wenstrup (R-Cincinnati) on 27 February 2019.

Caribbean Ambassadors in Washington with US Assistant Secretary, Bureau of Western Hemisphere Affairs. Kim Breier, at the US State Department. Sir Ronald third from right in January 2019.

Caribbean Ambassadors in Washington with US Assistant Secretary, Bureau of Western Hemisphere Affairs. Kim Breier, at the US State Department. Sir Ronald third from right in January 2019.

In July 2018, while in Ottawa for Antigua and Barbuda bilateral talks with Canadian government officials, Sir Ron ran into old and repected friend, Joe Clarke - former Prime Minister and Foreign Minister of Canada and a great warrior in the anti-apartheid struggle.

In July 2018, while in Ottawa for Antigua and Barbuda bilateral talks with Canadian government officials, Sir Ron ran into old and repected friend, Joe Clarke - former Prime Minister and Foreign Minister of Canada and a great warrior in the anti-apartheid struggle.

With Ambassador Jesus Silvera of Panama, receiving a donation to the rebuilding of Barbuda, June 2018

With Ambassador Jesus Silvera of Panama, receiving a donation to the rebuilding of Barbuda, June 2018

With OAS Secretary-General, Luis Almagro, on 6 June 2018, signing the Inter-American Convention against Racism, Racial Discrimination and Related Forms of Intolerance. Antigua and Barbuda was the first signatory to the Convention and the second country to ratify the Convention.

With OAS Secretary-General, Luis Almagro, on 6 June 2018, signing the Inter-American Convention against Racism, Racial Discrimination and Related Forms of Intolerance. Antigua and Barbuda was the first signatory to the Convention and the second country to ratify the Convention.

Signing ceremony in Washington, DC of Abolition of Visa Requirements between Ukraine and Antigua and Barbuda in May 2018. Ukraine Amnbasador (left) and Joy-Dee Davis, Minister Counsellor, Antigua and Barbuda Embassy (right)

Signing ceremony in Washington, DC of Abolition of Visa Requirements between Ukraine and Antigua and Barbuda in May 2018. Ukraine Amnbasador (left) and Joy-Dee Davis, Minister Counsellor, Antigua and Barbuda Embassy (right)

With Governor-General of Canada,Her Excellency Julie Payette, at Rideau Hall in Ottawa on January 30th 2018. In addition to beeing accredited to Canada as High Commissioner, I have the honour of sharing the distinction with this amazing former Astronaut of being a Senior Fellow at Massey College in the University of Toronto.

With Governor-General of Canada,Her Excellency Julie Payette, at Rideau Hall in Ottawa on January 30th 2018. In addition to beeing accredited to Canada as High Commissioner, I have the honour of sharing the distinction with this amazing former Astronaut of being a Senior Fellow at Massey College in the University of Toronto.

.jpg) In Tobago after delivering feature address at The Tobago Finance week on 13 November 2017. Photo shows, Economist Terrence Farrell, Sir Ronald, Tobago Deputy Chief Secretary Joel Jack, and Anthony Pierre, Chairman of the Caribbean Association of Chartered Accountants

In Tobago after delivering feature address at The Tobago Finance week on 13 November 2017. Photo shows, Economist Terrence Farrell, Sir Ronald, Tobago Deputy Chief Secretary Joel Jack, and Anthony Pierre, Chairman of the Caribbean Association of Chartered Accountants

In Port-of-Spain, Trinidad speaking at the annual Conference of the Institute of Chartered Accountants of Trinidad and Tobago on 9 November 2017

In Port-of-Spain, Trinidad speaking at the annual Conference of the Institute of Chartered Accountants of Trinidad and Tobago on 9 November 2017

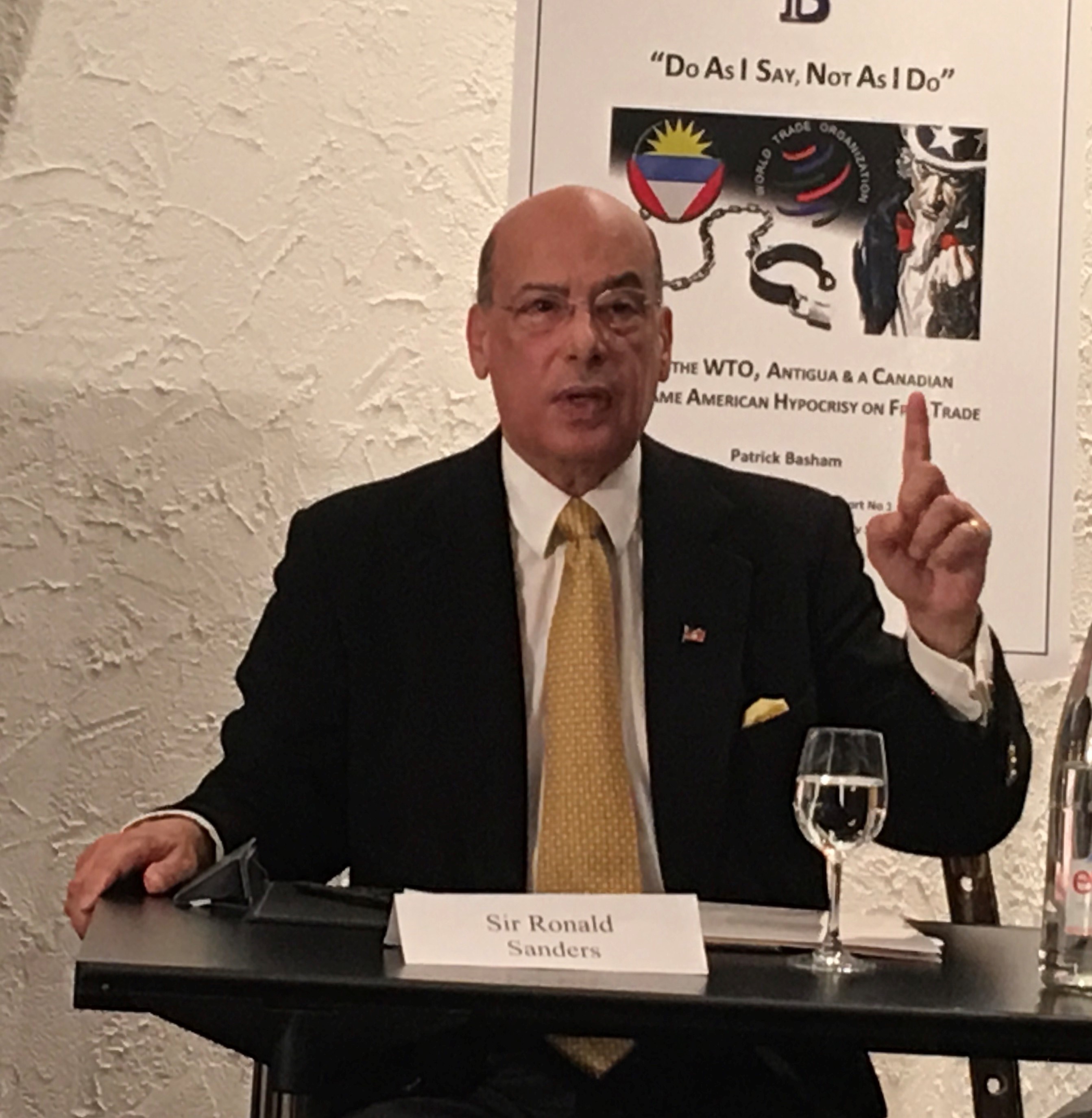

Speaking at a meeting in Geneva, prior to appearnace at the World Trade Organisation on Antigua and Barbuda's contention with the US government on the WTO award to Antigua over Internet Gaming, September 2017

Speaking at a meeting in Geneva, prior to appearnace at the World Trade Organisation on Antigua and Barbuda's contention with the US government on the WTO award to Antigua over Internet Gaming, September 2017

Speaking on Refugees resulting from Climate Change and the growing danger to small island states at an event organised by OXFAM in Washington, DC on 30 October 2017. (Heather Coleman, OXFAM; Sir Ronald Sanders, Antigua and Barbuda; Selwyn Hart (Barbados), Lisa Friedman, New York Times)

Speaking on Refugees resulting from Climate Change and the growing danger to small island states at an event organised by OXFAM in Washington, DC on 30 October 2017. (Heather Coleman, OXFAM; Sir Ronald Sanders, Antigua and Barbuda; Selwyn Hart (Barbados), Lisa Friedman, New York Times)

Sir Ronald speaking at the National Press Club in Washington DC on 12 October 2017. He was talking about the devastation of Barbuda by Hurricane Irma and the remedies for Climate Change and Global Warming. To his left are: The Prime Minister of Grenada Dr Keith Mitchell, CARICOM Secretary General Irwin la Rocque and St Lucia Prime Minister Alan Chastanet

Sir Ronald speaking at the National Press Club in Washington DC on 12 October 2017. He was talking about the devastation of Barbuda by Hurricane Irma and the remedies for Climate Change and Global Warming. To his left are: The Prime Minister of Grenada Dr Keith Mitchell, CARICOM Secretary General Irwin la Rocque and St Lucia Prime Minister Alan Chastanet

.JPG) Sir Ronald speaking at the Centre for Strategic and International Studies (CSIS) on the security and other threats posed to the Caribbean and the Hemisphere of Climate Change and Global Warming on 13 September 2017

Sir Ronald speaking at the Centre for Strategic and International Studies (CSIS) on the security and other threats posed to the Caribbean and the Hemisphere of Climate Change and Global Warming on 13 September 2017

Sir Ronald (third right) with senior officers of the Inter-American Defense Board in Washington, DC after discussing what assistance could be given in the clean up and rebuilding of Barbuda after Hurricane Irma (Friday, 15 September 2017)

Sir Ronald (third right) with senior officers of the Inter-American Defense Board in Washington, DC after discussing what assistance could be given in the clean up and rebuilding of Barbuda after Hurricane Irma (Friday, 15 September 2017)

With US Congressman, Ranking member of Committee on Foreign Affairs at Capitol Hill on 14 September, discussiing secutty matters, Hurricane Irma and Barbuda and the US-Antigua and Barbuda WTO issues. Very helpful.

With US Congressman, Ranking member of Committee on Foreign Affairs at Capitol Hill on 14 September, discussiing secutty matters, Hurricane Irma and Barbuda and the US-Antigua and Barbuda WTO issues. Very helpful.

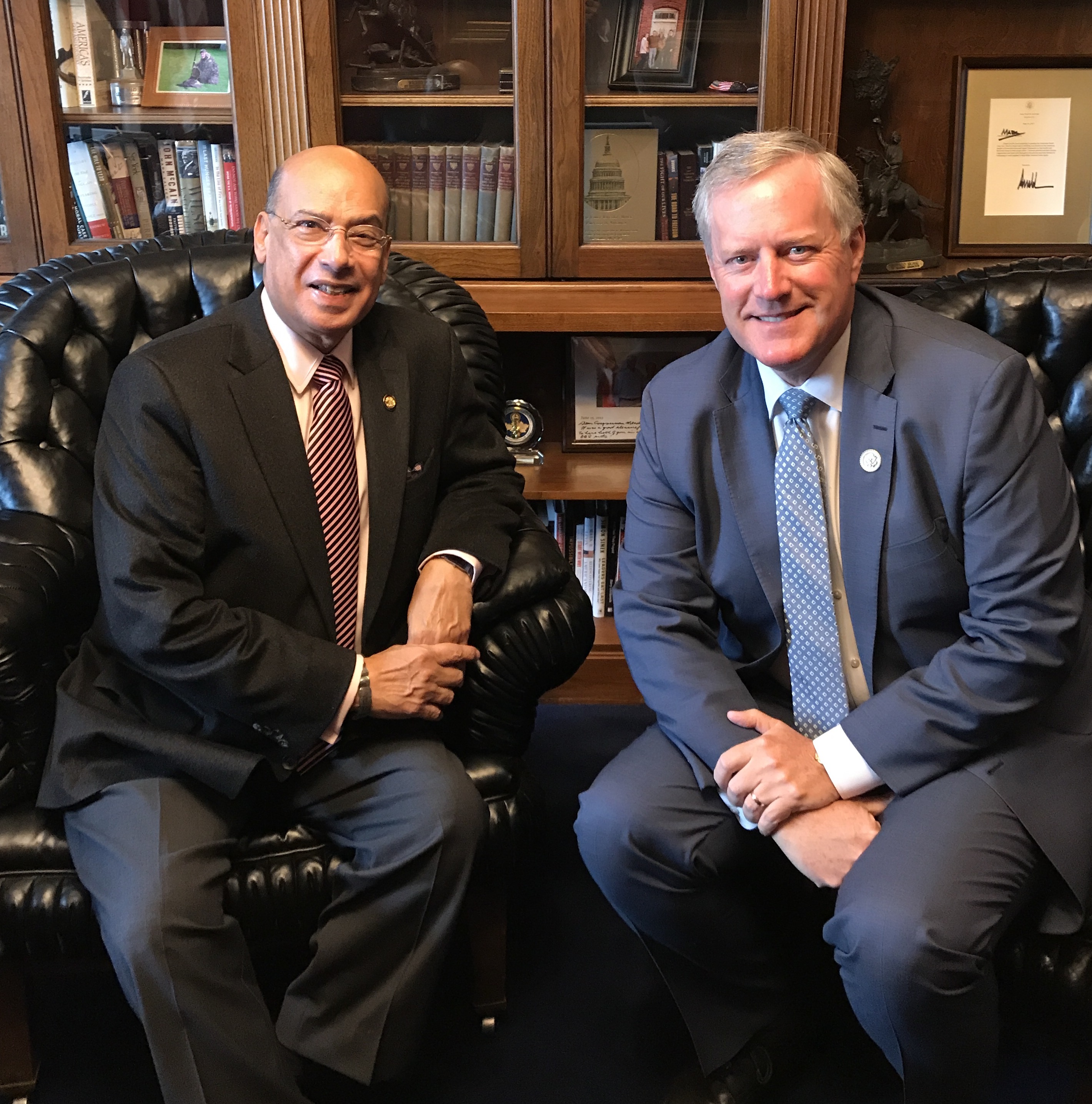

With US Congressman Mark Meadows on Capitol Hill talking the US-Antigua and Barbuda WTO issues, and the effets of Hurricane Irma on the island of Barbuda on 12 September, 2017. Good man.

With US Congressman Mark Meadows on Capitol Hill talking the US-Antigua and Barbuda WTO issues, and the effets of Hurricane Irma on the island of Barbuda on 12 September, 2017. Good man.

Talking to the Emergency Agencies of the OAS about the impact of Hurricane Irma on the island of Barbuda and seeking assistance on 14 September 2017

Talking to the Emergency Agencies of the OAS about the impact of Hurricane Irma on the island of Barbuda and seeking assistance on 14 September 2017

Sir Ronald with Canadian Prime Minister Justin Trudeau in Ottawa on 28 August 2017 discussing Canada-Antigua and Barbuda bilateral matters.

Sir Ronald with Canadian Prime Minister Justin Trudeau in Ottawa on 28 August 2017 discussing Canada-Antigua and Barbuda bilateral matters.

Sir Ronald with the President of Mexico, Enrique Pena Nieto, at the General Assembly of the Organisation of American States in Cancun, in June 2017

Sir Ronald with the President of Mexico, Enrique Pena Nieto, at the General Assembly of the Organisation of American States in Cancun, in June 2017

Heads of Delegations to the OAS General Assembly in Cancun. Mexican Presdident, sixth from right, front row. Sir Ronald fourth from right, front row.

Heads of Delegations to the OAS General Assembly in Cancun. Mexican Presdident, sixth from right, front row. Sir Ronald fourth from right, front row.

Meeting of Consulation on the situation in Venezuela at the Organisation of American States on 31 May 2017 Sir Ronald (far right).

Meeting of Consulation on the situation in Venezuela at the Organisation of American States on 31 May 2017 Sir Ronald (far right).

With Texas Congressman Randy Weber at Capitol Hill in Washington DC, talking energy, water and US-Antigua and Barbuda relations on Wednesday 5 April, 2017

With my colleague Argentine Ambassador to the OAS, Juan Jose Acuri (right) and the Argentina candidate for election to the Inter-American Commission on Human Rigjts Dr Carlos de Casas on 29 March 2016

At the International Monetary Fund with Exceutive Director for Canada and the Caribbean, Nancy Horsman, to discuss Antigua and Barbuda matters.

At the International Monetary Fund with Exceutive Director for Canada and the Caribbean, Nancy Horsman, to discuss Antigua and Barbuda matters.

At the Antigua and Barbuda Embassy receiving Antonia Urrejola, the candidate of Chile for the Inter American Commission on Human Rights, on 23 March 2017

With the Mexican Candidate for the Inter American Commission on Human Rights, Joel Hernadez Garcia, on 21 March 2017

With the Mexican Candidate for the Inter American Commission on Human Rights, Joel Hernadez Garcia, on 21 March 2017

At the World Bank on20 March 2017 meeting Christine Hogan, the Executive Director for Canada and the Caribbean, to talk about Antigua and Barbuda matters.

At the World Bank on20 March 2017 meeting Christine Hogan, the Executive Director for Canada and the Caribbean, to talk about Antigua and Barbuda matters.

With Joe Barton, US Congressman from the State of Texas in his Office on Capitol Hill on Thursday, 16 March 2017 discussing US-Antigua and Barbuda relations

Hosting a meeting at the Antigua and Barbuda Embassy in Washington, DC of diplomatic representatives of St Lucia (Ambassador Anton Edmunds, St Kitts-Nevis Ambassador Thelma Phillip-Browne and St Vincent Deputy Chief of Mission Omari Williams)

Hosting a meeting at the Antigua and Barbuda Embassy in Washington, DC of diplomatic representatives of St Lucia (Ambassador Anton Edmunds, St Kitts-Nevis Ambassador Thelma Phillip-Browne and St Vincent Deputy Chief of Mission Omari Williams)

Meeting the Cuban Ambassador to the United States, Jose Cabanas Rodriguez at the Antigua and Barbuda Embassy on Tuesday, 21st February, 2017

Meeting the Cuban Ambassador to the United States, Jose Cabanas Rodriguez at the Antigua and Barbuda Embassy on Tuesday, 21st February, 2017

With the Ambassador of Ecudaor to the United States, Francisco Borja Cevallos, talking Ecuador-Antigua and Barbuda relations on 13 February 2017

With the Ambassador of Ecudaor to the United States, Francisco Borja Cevallos, talking Ecuador-Antigua and Barbuda relations on 13 February 2017

With US Congressman Gus Bilikakis (Dem,Fl) for talls on Caiptol Hill in Washington

With US Congressman Gus Bilikakis (Dem,Fl) for talls on Caiptol Hill in Washington

.JPG) With Charlie Crist, US Congressman (Dem, Fl) for discussions on US-Antigua and Barbuda matters

With Charlie Crist, US Congressman (Dem, Fl) for discussions on US-Antigua and Barbuda matters

With US Senator Jeff Duncan, Chair Foreign Relations Committee talking energy and Citizenship by Investement Programmes in the Caribbean

With US Senator Jeff Duncan, Chair Foreign Relations Committee talking energy and Citizenship by Investement Programmes in the Caribbean

.jpg) With Professor Louis Gates Jr at the Smithsonian National Musuem of African American History in Washington, DC after an evening of enlightening presentations on the neglected story of the building of the US

With Professor Louis Gates Jr at the Smithsonian National Musuem of African American History in Washington, DC after an evening of enlightening presentations on the neglected story of the building of the US

March 17, 2014 in Barbados where I spoke with Dr Ralph Gonsalves, Caribbean thought leader and Prime Minister of St Vincent and the Grenadines (second right) at the launch of the late Jean Holder’s (third right) excellent book on Regional Transportation. All that Jean wrote remains relevant today. At far left is Warren Smith a former CEO of LIAT and, at the time, President of the Caribbean Development Bank. Each of us was born in different parts of the Caribbean, but all of us know that we are better off as One Caribbean.

March 17, 2014 in Barbados where I spoke with Dr Ralph Gonsalves, Caribbean thought leader and Prime Minister of St Vincent and the Grenadines (second right) at the launch of the late Jean Holder’s (third right) excellent book on Regional Transportation. All that Jean wrote remains relevant today. At far left is Warren Smith a former CEO of LIAT and, at the time, President of the Caribbean Development Bank. Each of us was born in different parts of the Caribbean, but all of us know that we are better off as One Caribbean.

Sir Ron speaking after receiving the Order of Australia in November 2012. The Medal is sees onthe left lapel of his jackedt. The award was made for “service to Australian relations, particularly concerning Commonwealth issues and advancing the interests of small developing states of the Caribbean region”

Sir Ron being Knighted by Her Majesty The Queen Elizabeth II at Buckinhgam Palace in 2002. The formal annoucement of the award of Knight Commander of the Most Distinguished Order ot St Michael and St George was made on 14 June 2002.

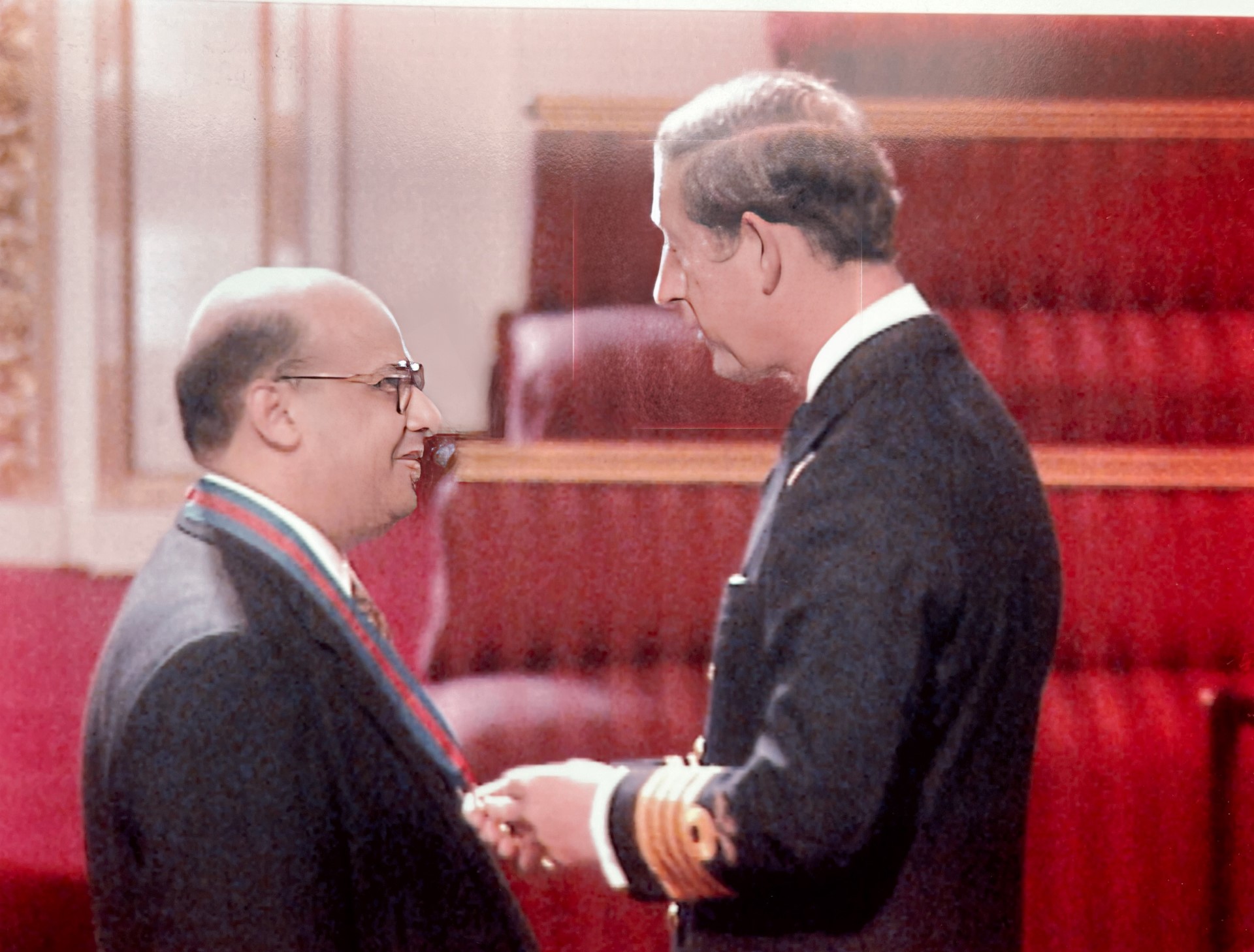

In 1997, Prince Charles, standing in for Her Majesty The Queen, Eizabeth II, officiated at the ceremony at Buckingham Palace at which the honour of Companion of the Most Distingushed Order of St Michael and St George (CMG). The award waa announced in Her Majesty's 1996 New Year's Honour list which was published on 30th December 1996.